seattle payroll tax calculator

Free Unbiased Reviews Top Picks. Our calculator has recently been updated to include both the latest Federal.

How Much Does A Small Business Pay In Taxes

Confidently Pay Employees and Never Worry About Tax Compliance Again.

. The calculator has built-in models that compute costs as a function of the information provided. Washington Salary Paycheck Calculator. These changing rates do not include the social cost tax of 122.

Ad Compare This Years Top 5 Free Payroll Software. Ad Check Our Payroll Software Comparison Charts To find Out Which One Is Most Suited For You. Ad Process Payroll Faster Easier With ADP Payroll.

Find The Best Payroll Software To More Effectively Manage Process Employee Payments. Talk To A Professional Today. On the surface this might be read to mean that an employee is primarily assigned to Seattle if as in the hours method the employee works exclusively at a business location of.

Find Easy-to-Use Online Payroll Companies Now. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Learn More About Our Payroll Options.

All Services Backed by Tax Guarantee. Ad See How MT Payroll Services Can Help Your Business. Washington Hourly Paycheck Calculator.

Ad Payroll Doesnt Have to Be a Hassle Anymore. While local sales taxes in Seattle Tacoma and some other metro areas are significantly higher than the national average. 2021 Social Security Payroll Tax Employee Portion Medicare Withholding 2021 Employee.

Ad Payroll So Easy You Can Set It Up Run It Yourself. 2021 Social Security Payroll Tax Employee Portion Medicare Withholding 2021 Employee Portion To contact the Seattle Department of Revenue please call 360-902-9620. Seattle Payroll Tax Calculator.

View the Demo Today. Employers can file a tax return online. You are able to use our Washington State Tax Calculator to calculate your total tax costs in the tax year 202223.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Seattle Payroll Tax Calculator. Use the paycheck calculator to figure out how much to put.

For 2022 the wage base is 62500. The Washington Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Washington. Employers in the first bracket will be taxed.

The seattle payroll tax is. Employers in the first bracket will be taxed. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

Your household income location filing status and number of personal exemptions. Get Started With ADP Payroll. Ad Gusto makes it easy to pay contractors today W-2 employees tomorrow.

Rates also change on a yearly basis ranging from 03 to 60 in 2022. Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Gusto makes it easy to pay contractors today W-2 employees tomorrow.

Use ADPs Washington Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Calculate your Washington net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state. The seattle payroll tax is.

Determine the right amount to deduct from each employees paycheck. Simplify Your Employee Reimbursement Processes. As detailed in the original article published by Clark Nuber in July 2020 the Seattle City Council passed City Ordinance 126108 establishing a new Seattle payroll expense tax that takes effect.

No Need to Transfer Your Old Payroll Data into the New Year. Ad Discover The Most Intuitive Client-Driven Solution. How to File a Tax Return.

Summarize deductions retirement savings required taxes and more. Employers must calculate the Seattle payroll for all employees including those earning less than 150000. Just enter the wages tax withholdings and other information required.

Start Afresh in 2022.

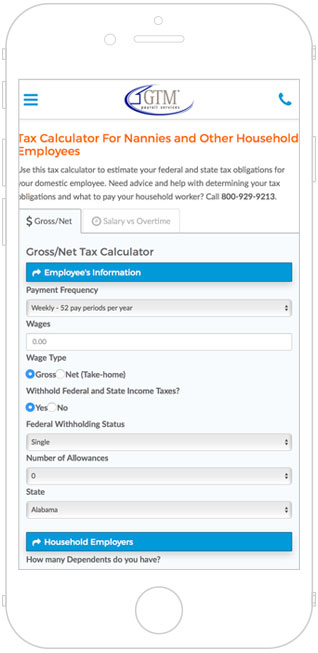

Nanny Tax Payroll Calculator Gtm Payroll Services

Washington Paycheck Calculator Smartasset

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

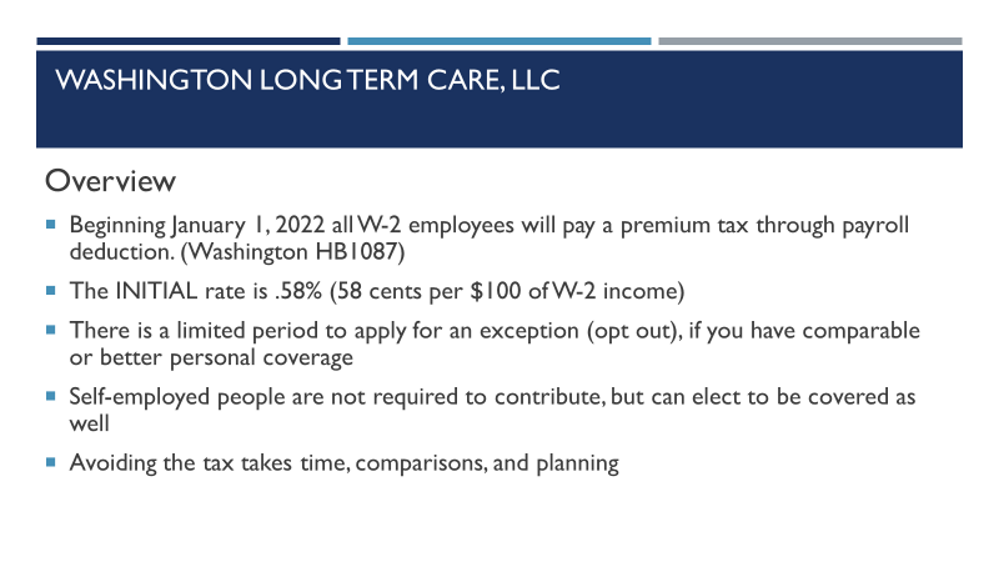

Payroll Washington Long Term Care Llc

Nanny Tax Payroll Calculator Gtm Payroll Services

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

1 600 After Tax Us Breakdown September 2022 Incomeaftertax Com

Tax Calculator Gavin Group Gavin Group

Tax Calculator Gavin Group Gavin Group

Is A State With No Income Tax Like Washington Better Or Worse The Seattle Times

Washington Paycheck Calculator Adp

How To Calculate Your Real Cost Of Labor Remodeling

Tax Calculator Gavin Group Gavin Group

Should You Move To A State With No Income Tax Forbes Advisor

Washington Paycheck Calculator Smartasset

How To Claim A Closing Cost Deduction On A Tax Return Income Tax Tax Deductions Tax Return

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Payroll Taxes

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

/remote-taxes-2000-529e2f73644e4f3b96853cc578c73217.jpg)

How Remote Work Affects Your Taxes And Deductions You May Qualify For